The Three Circles: Our Independent Model

The “Know Your Client” (KYC) Paradox

Generally speaking, the first step in the investment process is the “Know Your Client” (KYC) questionnaire. This is a quiz designed to examine how to invest in a suitable manner. You will answer a few subjective and objective questions that will spit out a number or letter grade to determine how you should invest.

Basically some arbitrary grade determines which box you fit into. The higher the number, the more “risk” that box will allow. In this case risk is represented by the amount of equity (generally stocks) a portfolio may hold and how much international exposure is allowed.

The Paradox our industry faces, in our opinions, is that regardless of the score you receive; two things are happening:

Suitability has not been determined in any way

You will likely be invested into Balanced profile with nearly all money invested in Canada regardless of your score

Thus the paradox of the system: a score determines your outcome, but the correct outcome is rarely, if ever, chosen.

There may be a box that is more suitable, or perhaps a portion of your portfolio requires more or less risk, but since your score is already determined it is difficult to add or remove components without changing the score.

If the KYC is the prologue to our story, the Canadian Balanced Profile is our first chapter…

The First Circle:

This first circle represents the overwhelming majority of investors capital in Canada today: The Canadian Balanced Profile.

The idea here is that if you own bonds (Fixed Income), stocks (Equity) and perhaps some Cash (GIC’s, Cash Accounts or Government Bonds), you have a safe, effective and diversified portfolio.

There are three simple problems here:

You are neither safe nor diversified: Your cash component will likely be outperformed by inflation which means you are losing money.

Generally speaking, there is an inverse relationship between stocks and bonds; when one is up, the other is likely down and vice versa. Therefore, you are losing money.

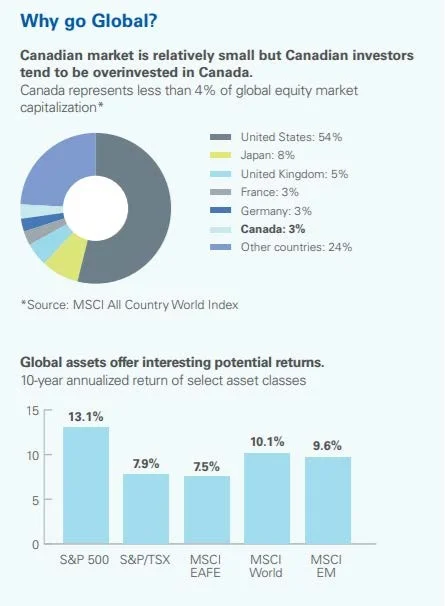

The majority of your capital, if not all, is invested in Canadian funds. Canada makes up ~2% of global growth and our entire economy relies heavily on a single resource.

We are small, we are volatile.

In this model, 66.6% of your invested capital is losing ground almost all of the time.

Among other problems, we aim to first fix the issue of ‘Cash’ in the portfolio.

Let’s invest this in the most simple and efficient way possible: in equities (Stocks).

Stocks are liquid, they are abundant and they are simple.

But this leads us to another problem: Asset Allocation and timing the market.

“While the classic inverse relationship between stocks and bonds appears to hold up in a majority of the simulations, there are still likely to be short periods when it doesn’t. But these exceptions to the norm shouldn’t lead you to abandon your long-term investment strategy.”

None of us has the ability to see into the future, therefore we are making guesses about when is the best time to be a bond investor, and when is it the best time to be a stock investor; trying to time the market.

We know this doesn’t work out in our favour long term.

We also know that in general, stocks outperform bonds in the long term, even though they are more volatile in the short term.

Our investment model is not about timing the markets. We are about “time in” the markets.

Which leads us to the second of three circles.

The Second Circle:

The second circle removes the temptation to try to manage two complex global markets, and reduces our exposure to only equities on a global scale.

The intent here is to take advantage of a globalized and “sector-ized” market of Global Equities (Stocks). Diversifying your portfolio into a wide variety of countries and sectors.

We are not bond people.

The bond market is at least twice as large and infinitely more complex than the stock market. Stocks are relatively simple, buy a stock, price goes up. Sell a stock, price goes down. The bond market is essentially the make up of every single underlying asset on the planet. The return derived from Bond is based on a large number of assets.

Not knowing what these assets may be adds a serious complication to the proceedings.

Ergo: Bonds are complex.

After-all, the saying isn’t: “Keep it complex, stupid!”

An Andex chart can be used to simply illustrate the concept that stocks outperform over time, it is how we manage volatility that is the key to success here.

A portfolio that invests all over the world in either stocks, or bonds will create positive returns… so sayeth the data!

If we recall the KYC Paradox, this concept puts us in a similar situation. Which is why we rely on more than just a simple quiz to “Know Our Client”.

We are in the business of creating a positive investment experience through education and relationship building both with individuals and the community.

With education comes and understanding of risk, which in turn may lead to a higher score on the KYC.

Our portfolio is invested into what are called “Segregated Funds” or Seg Funds. Segregated funds are annuity contracts managed by a portfolio manager that invests money on your behalf. (Similar to Mutual Funds, Click here to find out the differences between the two).

We use these contracts to remove some risk from the portfolio by adding guarantees, named & preferred beneficiaries that bypass the will and probate, full creditor protection and the potential to lock in market gains through the use of resets of guarantees.

This is a safe and effective way to build a global portfolio and prevent capital erosion over time.

Along came Smartphone…

In June of 2007 the world was introduced to the iPhone and the world went from small to minuscule.

The introduction of the pocket supercomputer ensured that every single person who owns one, has access to the entirety of human knowledge. Turns out, this is a nightmare when combined with apps to buy and sell assets online with little to no information or thought.

Seemingly just emotion.

In the past, our models’ second circle was the “Asset Allocation” method of investing. But now, we see that having simply a Global portfolio of equities is no longer viable, and no longer diversified enough.

We can’t escape the new generation of emotion driven day traders…

Canada Pension Plan: diversified, safe, and a model to follow!

Do as the pensions do!

Did you know that the Canadian Pension Plan (CPP) has had a compounded rate of return of 12.25% since 2000?

Wanna know how they did it?

By diversifying A) beyond the Canadian marketplace and B) by further diversifying into specific private investments all over the globe and using revenues from profits to make further investments into an ever diversified portfolio while reducing exposure to bonds and cash over the last 18 years.

In 1998 Canadian Pension rules changed allowing pension management to divest from a portfolio largely made of Canadian Government Bonds.

If this method is suitable enough to grow assets at CPP from $44.5B in 200 to $356.1B+ in 2018, it is probably good enough for you, because guess what?

Your money is already invested like that at CPP.

We can take a similar approach by purchasing A selection of private placements, which in the past had to be done through illiquid means in high risk ventures. Now we can find similar investment styles in Segregated Funds throughout Canada.

By taking a portion of your portfolio and investing in a series of diversified options, we have the potential to reduce volatility while increasing overall returns in the long run.

Just like pension plans and endowment funds…

Also like Pension Plans and Endowment funds we will use profits to generate a revenue cycle that is used to consistently create more diversity in the portfolio overall.

From time to time we may use small percentages of the portfolio higher risk private investments, while the majority balance of your portfolio stays liquid and available to you at all times.

This makes up the concept of the modern third circle.

Circle three

The final circle in the trio is a model that has evolved and developed over five decades to fit the needs of a truly modern investor.

Actively managed, efficient, suitable for a vast scope of investors.

Isn’t it time to ask someone which circle you are in?

If you think it is time for a change, give us a shout, we will happy to help you find a better way to invest.