...RUN OUT THE LONG GUNS!

“you know, I think it is time to keep the powder dry…” often attributed to cowboys, and used as a term to play it safe, back away from the source of the energy.

Did you know the full idiom is attributed to a British Navy military officer who told his troops “pray to god and keep your powder dry!” on the high seas before a major naval operation WHERE THEY SHOT AT EACH OTHER WITH CANNONS?!

Now you do, and we’re using it wrong. What is worse, we’re using it wrong at the wrong time.

Now is not the time to safely stash the powder away, it is time to attack. If we’re keeping with the spirit of the adage, this is the time of year that is best to go on the attack, ready the cannons and prepare for war!

So dramatic, right?

Historically, August and September are the best months to invest, because historically, August and September are the worst months produced in the markets in any given year.

This isn’t the only reason to invest during the waning summer nights.

Stock sellers are having a hard time selling stocks. If you are a fund manager, and you’re looking for discounts, you’re getting them now as opposed to January and February, at least in Canada, when the markets tend to be quite hot and stocks are scarce.

When stocks are scarce, prices are high, we don’t attack.

Right now, stocks, historically speaking, are abundant and relatively cheap. Which means it is a good time to ‘keep the powder dry’.

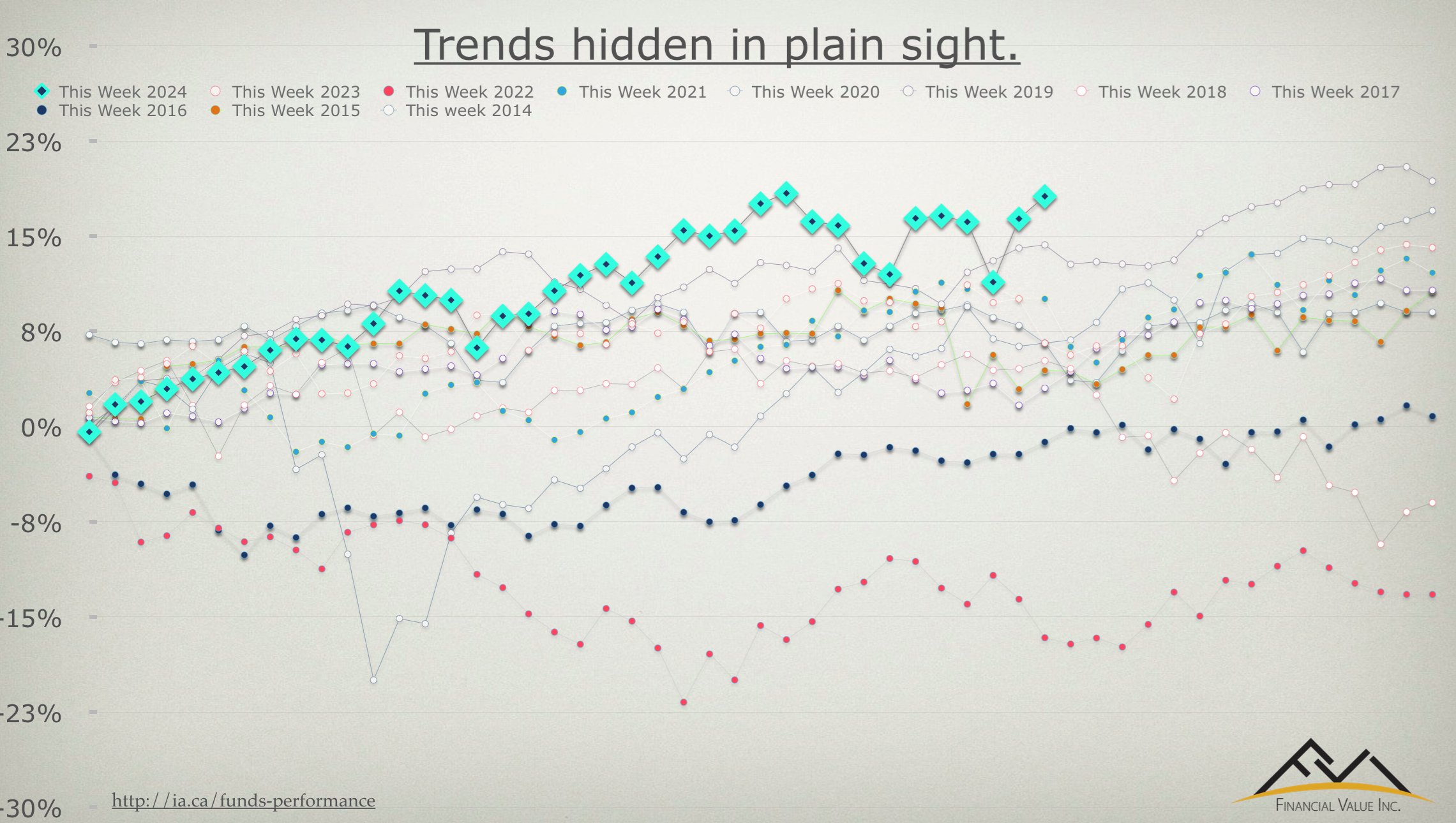

Here is more than a decade of data that shows the trends of the best times to buy, August and September nearly always dip and create opportunity.

This is a collection of data that shows a pretty obvious trend, stocks tend to slow or even decline through the summer and the earliest days of fall, and then pick up steam through the end of the year and peter out sometime in march with slower growth through the spring and early summer months.

Why does this happen?

Well, from our perspective, we begin to see a pullback in investing that begins to ramp up the closer you get to the end of the North American school year. People are paying past bills, and in our view, getting ready to take money to — get away — and that money tends to come from, at least in part, market driven investments.

So that slows the markets heading towards summer.

Later in the summer, through August, we tend to get a lot of Economic data on how the year has been going. This info comes from Central Banks and includes things like jobs data, inflation rates, how interest rates should be treated and a whole host of other things that make people skittish.

Another phenomenon, ‘Back to School’, the real start of the year for most people, begins what we like to call “Spending Season”, which lasts from mid august through to St Patrick’s day.

People spend a lot of money this time of year. Economists and talking heads know this, and tend to put a lot of pressure on the beginning earnings and current slow data of the so called season, which often scares off a lot of investors. So timing becomes an issue.

People want to wrongly state they’re keeping their powder dry, when again, to stick with the metaphor here, they aren’t even out to sea yet.

But they should be.

If we believe markets generally go down, at this time of year, why aren’t we investing more?

Why aren’t we doing more investing in September when markets tend to be at their lowest through the year?

See the chart above, decide when is best to run out the long guns… it is indeed time to keep the powder dry.

It won’t be shocking to hear this come from me; but it is because we are herd creatures and if the herd isn’t trending in that direction, it isn’t happening.

Right now, people are in a panic over the US election. I won’t say it isn’t important, but the markets have already decided on a winner and the actual results don’t tend to shake the markets very much.

Odds are, the year ends quite well for us, resulting in a banner year. One we will certainly be willing to hang from the rafters. (speculation)

*

I certainly know who I would prefer to win, (personal political beliefs)** but to the markets, at least for the time being, there are no real secrets. So whomever wins, it is very likely you will see another solid year in 2025.

What is interesting, what we are hearing from our trusted sources; economists like Sebastien McMahon and some of our fund managers, is that the Canadian Economy will likely outperform the American economy next year, which will lead to continued success for our Canadian portfolio and may lead some of you to ask why we aren’t loading up on Canadian equities now to prepare for this.

Well, there is a long answer for this, and as we are approaching 1,000 words, I want to break our plans for Q4 24, 2025 and 2026 into separate chunks. There is a lot to say. Some of it is political, so I want to ensure we are using proper context while discussing politics, and ensure the context is very clear so we can generate as much constructive conversation as possible.

We look at policy in a way that is reflective of the portfolio, not whether or not we personally like what is happening.

** Think: regardless of whether I like the person or party who built the policy, how does it effect my portfolio?

* Some of what we have to say is fairly speculative as we use the information we have now to make decisions about the future, so we want to share our perspective and experience backed with data that is useful to you and easy to understand.

So for now, I will leave you with this:

We are ready to attack, we have the data we need to do so, so keep your powder dry and join us at see Maytees! Yar! (If I took this metaphor too far, let me know. lol)

Thanks for reading and expect part 2 in the coming days.

Darris Cameron

CEO

Financial Value Inc.